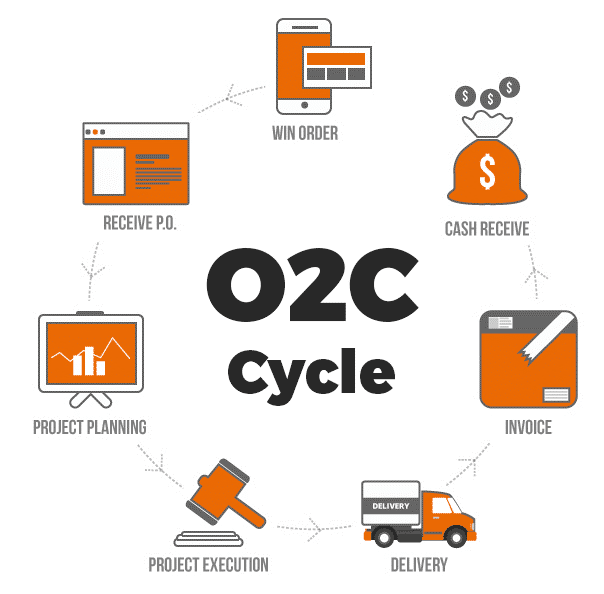

In today’s dynamic & competitive environment companies of all sizes are constantly seeking ways to streamline their operations and maximize their efficiency. The Order to Cash (O2C) cycle is a critical business process that encompasses all the steps involved in receiving, processing, and fulfilling customer orders, ultimately leading to revenue generation and that’s become easy with Grow Asia. It’s a fundamental process for any organization, especially in sales and distribution. The cycle typically involves several stages, including:

-

Order Entry

This is where the process begins. Customers place orders for products or services through various channels, such as in-person, phone, email, or online. Order details, including the items, quantities, prices, and shipping information, are recorded.

Order Entry

-

Order Confirmation

After an order is received, it is usually confirmed to ensure the accuracy and availability of the requested items. This step may involve verifying the customer’s credit, stock availability, and other factors that could affect the order.

Order Confirmation

-

Order Processing

Once the order is confirmed, it is processed. This involves picking the items from the warehouse or assembling them, packing them for shipment, and generating an invoice.

Order Processing

-

Invoicing

An invoice is created based on the order, which includes the cost of the products or services, taxes, shipping charges, and any other applicable fees. The invoice is then sent to the customer.

Invoicing

-

Payment Collection

The customer receives the invoice and, after reviewing it, makes the payment. This can be done through various methods, including credit card payments, checks, wire transfers, or online payment platforms.

Payment Collection

-

Order Fulfillment

Once payment is received, the goods or services are shipped or delivered to the customer. This may involve tracking the shipment and providing the customer with delivery updates.

Order Fulfillment

-

Accounts Receivable

The payments received from customers are recorded in the organization’s accounts. This step is critical for maintaining accurate financial records.

Accounts Receivable

-

Reconciliation

Periodically, the organization reconciles its accounts to ensure that all orders have been processed correctly and that payments match the invoices.

Reconciliation

-

Credit Management

Throughout the O2C cycle, credit management is essential to assess and manage the creditworthiness of customers. This helps in avoiding bad debt and minimizing financial risk.

Credit Management

-

Reporting and Analysis

Data generated throughout the O2C cycle is used for reporting and analysis. This information is crucial for making business decisions, optimizing the process, and improving customer satisfaction.

Reporting and Analysis

Conclusion:

An effective Order to Cash process should be characterized by efficiency, accuracy, and customer-centricity. It involves various stages, from order creation and management to product delivery, invoicing, and ultimately, the collection of payments. By streamlining these processes, companies can reduce operational costs, minimize errors, and enhance the overall customer experience. Top of FormIt also uplifts the company’s financial health and customer satisfaction.

Send us an email at info@growasia.sg – we can help you work through this process.