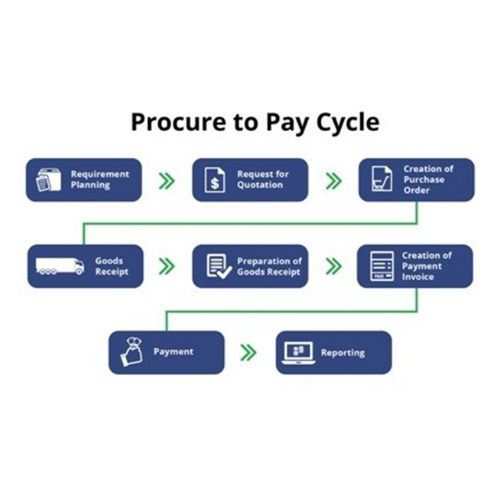

In today’s competitive business world efficient procurement and seamless payment procedure are essential for sustained growth and success. Procure-to-Pay (P2P) is a business process that facilitates the efficient and controlled acquisition of goods and services, beginning with the identification of procurement needs and ending with the disbursement of payments to suppliers. And with Grow Asia simplify this process which involves the entire sequence of activities and steps required to acquire goods and services for a company. It typically encompasses the following stages: –

-

Requisition:

This stage begins when a department or individual identifies the need for goods or services. They create a requisition, which is essentially a request for purchase. The requisition includes details such as item descriptions, quantities, and budget information.

Request for purchase

-

Supplier Selection:

The procurement department or relevant personnel identify potential suppliers who can fulfill the requisition. This involves evaluating suppliers based on factors like price, quality, reputation, and reliability.

Supplier Selection

-

Purchase Order (PO) Creation:

After selecting a supplier, a purchase order is generated. The PO is a legally binding document that outlines the terms and conditions of the purchase, including the item details, quantities, price, delivery dates, and payment terms.

Purchase Order (PO) Creation

-

Goods/Services Receipt:

When the supplier delivers the ordered goods or services, the receiving department checks the delivery against the purchase order to ensure accuracy and quality. If everything meets the criteria, the goods or services are accepted.

Goods/Services Receipt

-

Invoice Receipt:

The supplier sends an invoice to the purchasing company based on the terms specified in the purchase order. The accounts payable department or relevant personnel receive and verify the invoice for accuracy.

Invoice Receipt

-

Invoice Approval:

Invoices are reviewed and approved for payment. This step may involve various levels of approval within the company, depending on the invoice amount and company policies.

Invoice Approval

-

Payment Processing:

Once an invoice is approved, the payment is processed. This typically involves issuing a check, initiating an electronic funds transfer, or using another payment method as agreed upon with the supplier.

Payment Processing

-

Reconciliation:

The accounts payable department reconciles the payment with the approved invoices and the corresponding purchase orders. This ensures that the company’s financial records are accurate.

Reconciliation

-

Reporting and Analysis:

Companies often analyze P2P data to track spending, identify cost-saving opportunities, and improve procurement processes.

Reporting and Analysis:

-

Supplier Relationship Management:

Maintaining good relationships with suppliers is a vital part of P2P. This involves communication, negotiation, and collaboration to ensure a reliable and mutually beneficial partnership.

Supplier Relationship Management

Conclusion: –

The Procure-to-Pay (P2P) cycle is a comprehensive business process that facilitates the efficient and controlled acquisition of goods and services. It serves as a cornerstone for cost control, risk mitigation, supplier management, and financial transparency, enabling businesses to optimize their spending, enhance operational efficiency and maintain strong supplier relationships, ultimately contributing to their overall success and resilience in a rapidly evolving business environment.

Send us an email on info@growasia.sg – we can help you work through this process.