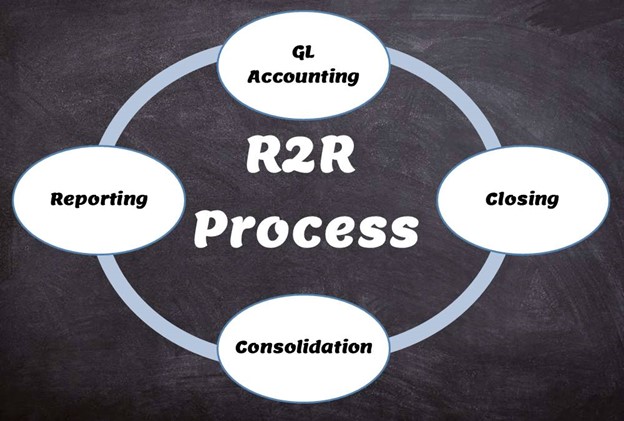

In today’s dynamic world, Record to Report is a key part of the financial management and reporting cycle and is essential for regulatory compliance, decision-making, and financial transparency. The “Record to Report” (R2R) cycle, also known as “R2R process,” is a set of financial and accounting activities that organizations perform to ensure the accurate and complete recording, reporting, and analysis of their financial transactions. It encompasses the entire financial accounting process, from the initial recording of transactions to the creation of financial reports. The primary goal of the R2R cycle with Grow Asia is to provide an accurate and transparent view of an organization’s financial health. The typical stages of the Record to Report cycle include:

-

Data Capture and Recording:

This is the initial stage where all financial transactions are recorded in the organization’s accounting system. This includes sales, expenses, payroll, and other financial activities.

Data Capture and Recording

-

Data Validation and Reconciliation:

In this step, the recorded data is checked for accuracy and completeness. It involves reconciling accounts, ensuring that debits and credits match, and identifying and correcting errors or discrepancies.

Data Validation and Reconciliation

-

Journal Entries:

Journal entries are made to record various accounting transactions, ensuring that they comply with Generally Accepted Accounting Principles (GAAP) or other relevant accounting standards.

Journal Entries

-

General Ledger Maintenance:

The general ledger is the central accounting repository that tracks all financial transactions. It is updated regularly to reflect changes in account balances.

General Ledger Maintenance

-

Closing the Books:

At the end of an accounting period (typically monthly, quarterly, or annually), the books are closed. This involves making adjusting entries, reconciling accounts, and preparing for financial reporting.

Closing the Books

-

Financial Reporting:

After the books are closed, financial reports are generated. These reports include income statements, balance sheets, cash flow statements, and other financial statements that provide insights into the company’s financial performance.

Financial Reporting

-

Audit and Compliance:

Many organizations undergo internal and external audits to ensure compliance with accounting standards and regulations. The R2R process supports these audit activities by providing an organized and transparent accounting system.

Audit and Compliance

-

Analysis and Decision-Making:

The financial reports generated in the R2R cycle are used by management for analysis and decision-making. This includes evaluating the company’s financial health, profitability, and planning for the future.

Analysis and Decision-Making

-

Budgeting and Forecasting:

Financial data from the R2R process is often used to create budgets and forecasts for the organization. This helps in setting financial goals and measuring actual performance against these goals.

Budgeting and Forecasting

-

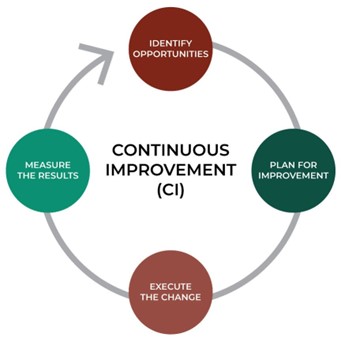

Continuous Improvement:

Organizations often review and improve their R2R processes to enhance efficiency, accuracy, and compliance. This may involve automation, process optimization, and software upgrades.

Continuous Improvement

In conclusion–

The Record to Report process is indispensable for the financial health and overall success of a business. It provides transparency, control, and efficiency in financial operations, contributing to better decision-making, risk management, and the overall sustainability of the organization. Businesses that invest in robust R2R processes are better equipped to navigate the complex and dynamic financial landscape.

Send us an email on info@growasia.sg – we can help you work through this process.